Discover the Right Home Loan Broker: Simplifying Home Financing

Browsing the complexities of home financing necessitates a critical approach, especially when it comes to choosing the ideal home mortgage broker. A skilled broker can simplify the procedure, straightening your one-of-a-kind economic account with ideal home loan options customized to your requirements.

Recognizing Home Loan Brokers

In the realm of home financing, understanding home mortgage brokers is necessary for prospective homeowners. Home mortgage brokers function as intermediaries between borrowers and lending institutions, helping with the lending acquisition process - veteran home loan. They assess customers' economic scenarios, choices, and needs to identify ideal home loan products tailored to specific situations

Furthermore, brokers usually take care of the application procedure, relieving a lot of the anxiety connected with safeguarding a mortgage. Eventually, recognizing the role and benefits of home mortgage brokers can equip potential property owners to make informed choices in their home financing journey.

Trick Certifications to Search For

When selecting a home mortgage broker, specific credentials can substantially influence the total experience and result of the home financing procedure. One of the primary credentials to think about is licensing; guarantee the broker holds a legitimate permit to operate in your state, as this shows they satisfy regulatory criteria.

Experience is one more crucial variable. A broker with a number of years in the sector is likely to have developed connections with lenders and a far better understanding of market fads. Try to find brokers who specialize in your desired type of funding, whether it be novice homebuyer programs or financial investment properties.

In addition, a solid performance history of effective deals speaks quantities. veteran home loan. Examine for customer testimonies and evaluations that highlight the broker's ability to shut loans effectively and provide exceptional customer care

Certifications, such as those from the National Organization of Home Loan Brokers (NAMB) or the Mortgage Bankers Organization (MBA), can also show professionalism and trust and dedication to ongoing education and learning. Social abilities ought to not be ignored; a broker that communicates plainly and listens attentively will be a lot more reliable in recognizing your unique monetary requirements.

Inquiries to Ask Possible Brokers

Picking the right mortgage broker involves not only evaluating their qualifications however likewise involving them with targeted concerns that expose their expertise and approach. Begin by asking regarding their experience in the market. Ask for how long they have actually been agenting car loans and whether they focus on certain kinds of home loans or customers, such as new homebuyers or financial investment homes.

Following, examine their interaction design. Ask how frequently they will upgrade you throughout the process and their preferred method of communication. This will assist you evaluate if their communication aligns with your assumptions.

You must also make inquiries regarding their lender connections. Understanding which lending institutions they deal with can provide understanding right into the range of lending alternatives readily available to you. Additionally, ask exactly how they take care of potential difficulties throughout see page the mortgage process and their technique to analytic.

Assessing Broker Charges and Expenses

Recognizing the various fees and expenses associated with hiring a mortgage broker is important for making an educated choice. veteran home loan. Mortgage brokers might charge a variety of fees, including origination charges, which compensate them for their solutions in protecting a car loan. These charges can vary from 0.5% to 2% of the finance quantity, so it's essential to clarify this upfront

Last but not least, understand any type of supplementary prices that might develop, such as application costs or credit score record costs. Ask for a detailed breakdown of all costs involved before signing any contracts.

Comparing fees across different brokers can help identify that supplies the most competitive prices and solutions. Inevitably, a detailed evaluation of broker costs and prices is crucial for making certain that you navigate to this site pick a home loan broker who provides value without unforeseen financial surprises.

Structure a Solid Broker Partnership

A strong connection with your home mortgage broker can dramatically boost your home-buying experience. This honesty enables your broker to give customized services that straighten with your needs.

Normal communication is essential in fostering a solid relationship. Set up regular check-ins to go over development, address concerns, and make clear any type of questions. This aggressive method maintains you notified and demonstrates your dedication to the process, allowing your broker to much better understand your choices and top priorities.

Furthermore, take into consideration supplying responses throughout the journey. Positive objection or gratitude assists your broker refine their technique, ensuring that your expectations are satisfied. Structure try here rapport can likewise bring about better settlement end results, as a broker who values your partnership is most likely to advocate intensely on your part.

Conclusion

In final thought, choosing a proper home mortgage broker is crucial for a structured home funding procedure. An educated broker not just promotes accessibility to numerous lenders but also supplies useful insights into the mortgage landscape. By considering essential certifications, asking significant inquiries, and evaluating linked fees, people can make enlightened choices. Developing a strong connection with the selected broker even more enhances communication and trust, ultimately adding to an extra effective and less stressful home-buying experience.

Emilio Estevez Then & Now!

Emilio Estevez Then & Now! Kel Mitchell Then & Now!

Kel Mitchell Then & Now! Joseph Mazzello Then & Now!

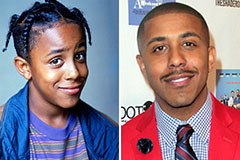

Joseph Mazzello Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Michael Fishman Then & Now!

Michael Fishman Then & Now!